Gas Turbine Services Market Progressing At USD 41.6 Billion By 2025 : Grand View Research Inc.

San Francisco, 23 October 2019: The Report Gas Turbine Services Market Size, Share & Trends Analysis Report By Turbine Type, By Turbine Capacity, By Service Type, By Service Provider, By End Use (Power Generation, Oil & Gas), And Segment Forecasts, 2018 – 2025

The global gas turbine service market size is expected to reach USD 41.6 billion by 2025, according to a new report by Grand View Research, Inc. The global market is anticipated to register a CAGR of 8.5% during the forecast period. Availability of natural gas in large quantities coupled with its relatively lower prices, especially in North America, China, and Thailand, has led to an increase in power generation using gas turbines.

The standby inspection (consist servicing of the relays cleaning, battery system, checking oil & water level and device calibration), running inspection, and combustion inspection (includes inspection of fuel nozzles and combustion liners) are the major maintenance and repair activities which are performed at different time interval, depending upon various factors such as operating hours, geographical condition, fuel, etc.

Growing focus on generating electricity through cleaner sources and discouragement of utilizing coal reserves are the factors anticipated to increase the share of gas turbines in the global energy mix. This, in turn, is expected to provide a favorable environment for the development of this market. One such strategy includes the recent orders passed by the current U.S. government to reverse the energy policies of the previous government and stop the war on coal, which is expected to boost the use of natural gas for energy production over the forecast period.

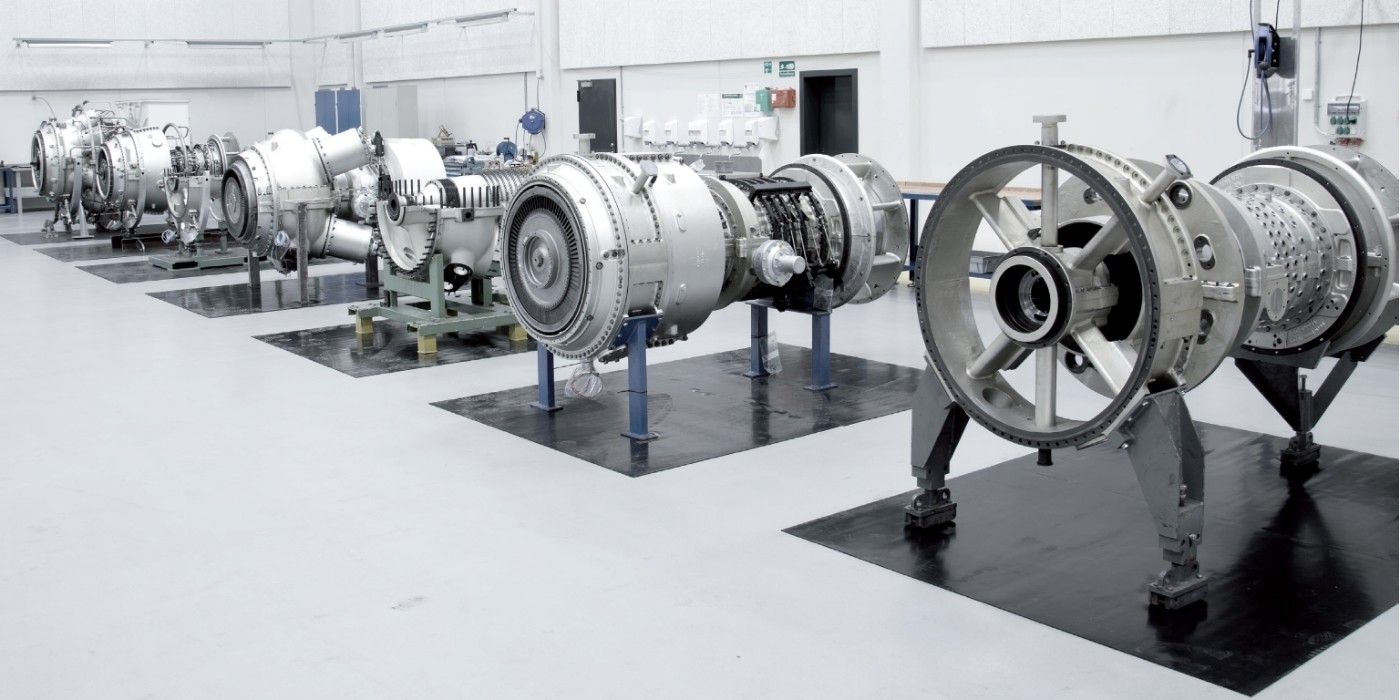

According to Diesel & Gas Turbine Worldwide, the total number of industrial gas turbines ordered in 2014 were 569 units, which increased to 581 in 2016. Of these, the total number of natural gas-fired industrial turbines, ranging from 30 MW to 120 MW, were 62 units in 2014 and reached 147 in 2016. Growth in industrial turbine installations across the globe is creating more opportunities for aftermarket services, which is building a favorable environment for the growth of gas turbine maintenance market.

Throughout their lifespan, the turbines undergo various inspections at different intervals. Combustor inspection (at 8,000-12,000 EOH), hot gas path inspection (at 24,000-50,000 EOH), and major inspection/overhaul (at 48,000-70,000 EOH) are some of the critical inspections that are essential for the reliable operation of gas turbines. Increasing utilization of gas turbines in resource extraction, processing applications, manufacturing facilities, and packaging plants is widening the product application scope, which is also projected to boost the aftermarket services for gas turbines. Increasing demand for the aftermarket services for gas turbine is projected to provide a substantial growth potential to the gas turbine service market.

Technological development in data collection methods is enabling players in this industry to form a constitutive model for materials. Test rig control helps in gathering and analyzing large volumes of data, thereby allowing players to create the most suitable maintenance plan and models for gas turbines.

Access Research Report of Gas Turbine Services Market @ https://www.grandviewresearch.com/industry-analysis/gas-turbine-services-market

Further key findings from the report suggest:

- The global gas turbine service market was valued at USD 23.9 billion in 2017. The market is projected to witness a CAGR of 8.5% during the forecast period

- The industry is highly consolidated in nature and is centered around five major players, which hold over 60% of the market

- Early defect detection through the use of software and the preventive maintenance results in substantial cost saving, which has increased the importance of service providers in gas turbine market

- Ease of maintenance and operation, higher efficiency, relatively lesser weight, and compatibility at offshore locations are some significant factors projected to drive the demand for <100 MW turbines

- The key players include GE Power, Siemens AG, Mitsubishi Hitachi Power Systems, Ltd. (MHPS), Kawasaki Heavy Industries, Ltd., and MAN Diesel & Turbo SE.

Grand View Research has segmented the global gas turbine service market on the basis of turbine type, turbine capacity, service type, service provider, end use, and region:

Gas Turbine Service Turbine Type Outlook (Revenue, USD Million, 2014 - 2025)

- Heavy Duty

- Industrial

- Aeroderivatives

- <100 MW

- 100 to 200 MW

- >200 MW

- Maintenance & Repair

- Overhaul

- Spare Parts Supply

- OEM

- Non-OEM

- Power Generation

- Oil & Gas

- Other Industrial

- North America

- Europe

- Asia Pacific

- The Commonwealth of Independent States (CIS)

- Central & South America

- Middle East & Africa

About Grand View Research

Grand View Research, Inc. is a U.S. based market research and consulting company, registered in the State of California and headquartered in San Francisco. The company provides syndicated research reports, customized research reports, and consulting services. To help clients make informed business decisions, we offer market intelligence studies ensuring relevant and fact-based research across a range of industries, from technology to chemicals, materials and healthcare.

For More Information: www.grandviewresearch.com

Comments

Post a Comment